With its ever-changing rules, navigating insurance billing can be tricky, especially if you’re doing it alone. Let’s explore what can be done to ease this sometimes painful process. Following these guidelines will benefit your practice by getting your claims paid correctly and promptly. Let’s dive in!

Medicare Supplement vs. Medicare Advantage/Replacement Plans

Patients who have Medicare Part B insurance have the following options concerning their insurance plan:

- Medicare only — Patients with Medicare Part B have a $240.00 annual deductible in 2024. Once the deductible is met, the plan pays 80% of the Medicare-allowed amount.

- Medicare Supplement — Patients with Medicare Part B may also choose a supplemental plan to cover their 20% co-insurance. Supplemental plans are offered by many carriers, including AARP (through UnitedHealthcare [UHC]), Mutual of Omaha, or Tricare for Life. While all supplemental plans should cover the 20% Medicare co-insurance, some plans will also cover the annual deductible.

- Medicare Supplement Plan F will cover Part B deductible and Part B co-insurance

- Medicare Supplement Plan G will only cover Part B co-insurance (not Part B deductible)

- Medicare Advantage/Replacement Plans (also known as Medicare Part C) — A patient may elect to have their Medicare coverage administered by a different insurance carrier. Claims are filed to, and paid by, the insurance carrier directly (e.g., UHC, Humana, Blue Cross Blue Shield). These plans may be either a PPO-type plan that will not require referrals or an HMO type that will require referrals. Many Medicare Advantage/Replacement plans may include additional benefits that are not covered by traditional or Part B Medicare. (Many patients will also provide you a copy of their traditional red, white, and blue Medicare card; if the patient has a Medicare Advantage/Replacement plan, traditional Medicare should not be entered in since it has been replaced, and the replacement card for the Advantage plan should be entered.) It is a good idea to take a copy of the traditional Medicare card to have on file, even if the patient provides a copy of their Medicare Advantage plan card; just be sure not to enter it into your OMS as part of the patient’s active payors.

Choosing the Correct Insurance

The first step in getting a claim paid is to ensure that it is received by the correct insurance carrier. A common error in claim submission is billing to Medicare when the patient has a Medicare Advantage/Replacement plan.

When a patient provides a copy of their Medicare ID card along with a secondary insurance ID card, you should confirm whether the secondary insurance ID card is for a Medicare Supplement plan or a Medicare Advantage/Replacement plan. Below are examples of three UHC Insurance ID cards, for a commercial insurance plan, a Medicare Advantage/Replacement plan, and a Medicare Supplement Plan.

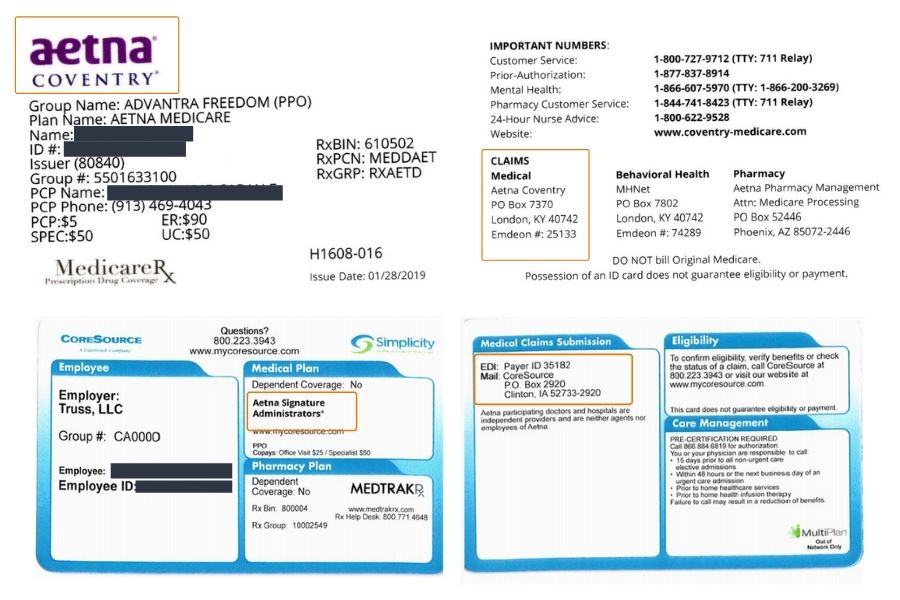

Some of the larger insurance carriers — such as Aetna, CIGNA, and UHC — have other insurance carriers and plans that are affiliated with the network. In some cases, the claims are submitted to and processed by the larger/parent network. In other cases, the claims are submitted to and processed by the affiliated network, with Aetna, CIGNA, or UHC being accessed only for the pricing/contractual discount.

In order to determine which insurance to choose, you will need to look closely at both the front and back of the insurance card to confirm if the claim needs to be submitted to the issuer of the insurance card or to the larger/parent network. A claim submitted to an incorrect insurance carrier may be rejected within a few days, but it also could take 30 to 45 days depending on the insurance.

The Aetna Medicare Plan — Advantra Freedom (PPO) — shows Aetna Network, but claims are submitted to the Coventry EDI Payer ID/claims mailing address:

Tips on Entering Patient Insurance Information

- Enter the patient’s name exactly as it is listed on their primary insurance card

- Enter the insurance ID number without any spaces or punctuation. A traditional Medicare Beneficiary ID number (MBI) will never contain the letter “O,” it will always be a zero, or “0.”

- Enter the payment source/payer type as per the listing below. This is required to ensure that the claim is submitted correctly and following the electronic claim guidelines for the plan type. Claims are rejected and/or denied when an incorrect payment source/payer type is used.

- Traditional Medicare only = Medicare

- Blue Cross, Blue Shield and Blue Cross Blue Shield = Blue Cross Blue Shield

- Traditional Medicaid only = Medicaid

- All other insurances = Commercial

For more advice and helpful tidbits, don’t hesitate to reach out to your Strategic Business Unit or learn about our billing and coding services for Audigy members. Navigating insurance billing can be tricky with its ever-evolving guidelines, but Audigy Billing & Collections is always here to make the process smoother for you.